Paul B Insurance Fundamentals Explained

Wiki Article

What Does Paul B Insurance Mean?

The idea is that the money paid out in cases with time will certainly be less than the complete premiums collected. You might seem like you're throwing cash out the home window if you never sue, however having item of mind that you're covered on the occasion that you do experience a substantial loss, can be worth its weight in gold.

Envision you pay $500 a year to insure your $200,000 residence. You have one decade of making repayments, and you have actually made no insurance claims. That comes out to $500 times ten years. This indicates you've paid $5,000 for house insurance policy. You start to wonder why you are paying a lot for absolutely nothing.

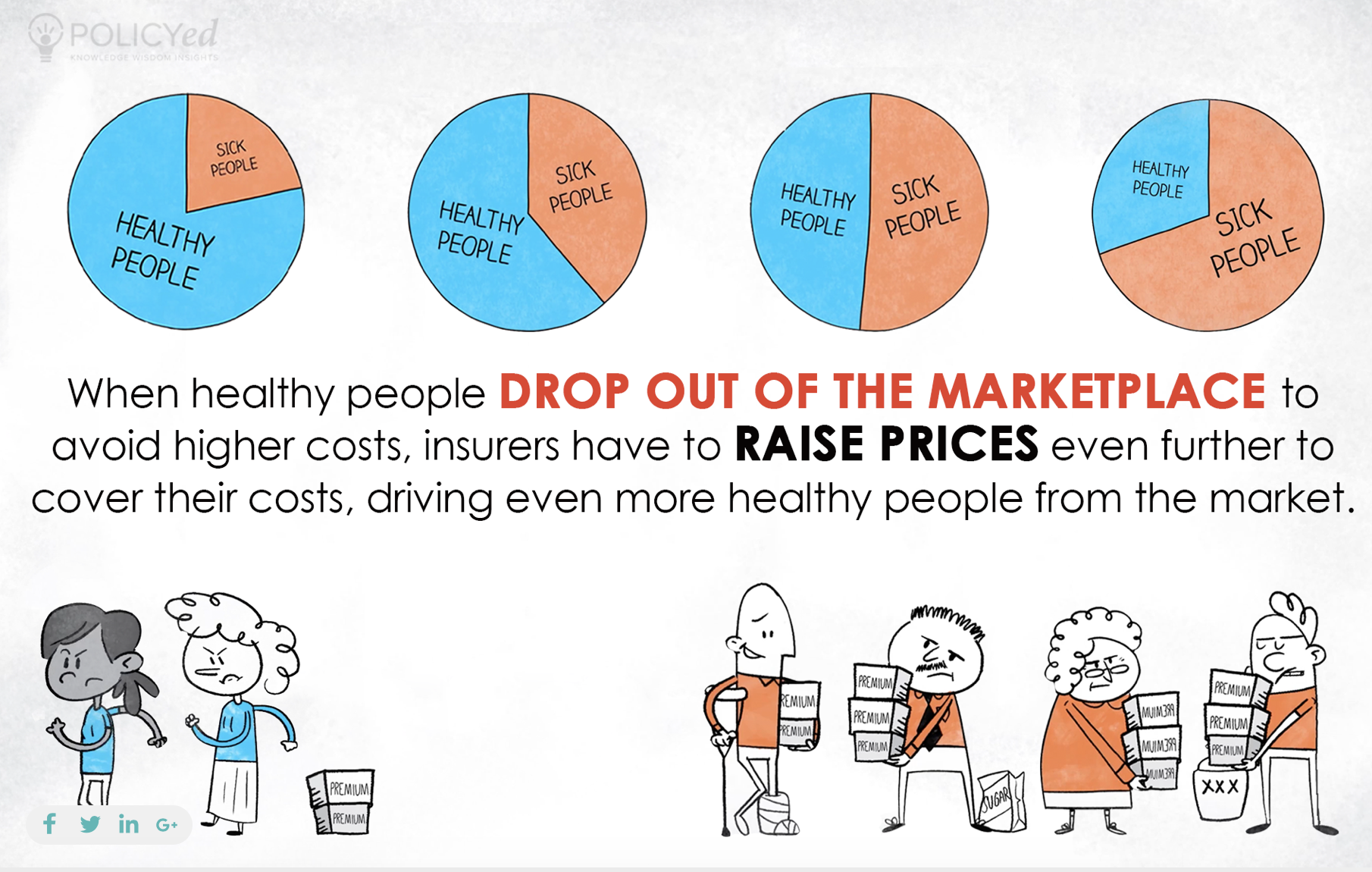

Because insurance coverage is based upon spreading the threat among many individuals, it is the pooled cash of all people spending for it that enables the business to construct assets as well as cover insurance claims when they take place. Insurance policy is a service. It would certainly be good for the business to simply leave rates at the very same degree all the time, the reality is that they have to make adequate cash to cover all the possible claims their insurance policy holders may make.

Not known Facts About Paul B Insurance

Underwriting adjustments and rate rises or reductions are based on results the insurance policy firm had in past years. They market insurance coverage from just one firm.

The frontline individuals you take care of when you acquire your insurance policy are the agents and brokers that represent the insurance provider. They will clarify the sort of items they have. The captive agent is a representative of just one insurer. They a knowledgeable about that business's items or offerings, however can not talk in the direction of other firms' policies, rates, or item offerings.

websites:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

They will certainly have access to greater than one firm and also need to understand about the series of products offered by all the firms they represent. There are a few vital concerns you can ask yourself that could assist you decide what sort of insurance coverage you require. How much threat or loss of money can you think on your own? Do you have the cash to cover your expenses or financial debts if you have an accident? What concerning if your residence or auto is messed up? Do you have the savings to cover you if you can't work as a result of a crash or ailment? Can you afford greater deductibles in order to lower your expenses? Do you have unique demands in your life that call for extra insurance coverage? What issues you most? Plans can be tailored to your requirements and also identify what you are most anxious about shielding.

browse around these guys

The Best Strategy To Use For Paul B Insurance

The insurance you need varies based on where you are at in your life, what type of possessions you have, as well as what your lengthy term objectives and also obligations are. That's why it is important to put in the time to review what you desire out of your plan with your agent.

If you get a lending to purchase an auto, and after that something happens to the vehicle, space insurance policy will certainly repay any part of your lending that standard automobile insurance coverage does not cover. Some lending institutions need their debtors to bring space insurance.

The major function of life insurance policy is to give cash for your recipients when you die. Depending on the type of plan you have, life insurance policy can cover: Natural fatalities.

All about Paul B Insurance

Life insurance covers the life of the guaranteed person. The insurance holder, who can be a different individual or entity from the guaranteed, pays premiums to an insurance provider. In return, the insurance company pays out an amount of cash to the beneficiaries detailed on the policy. Term life insurance policy covers you for a time period picked at acquisition, such as 10, 20 or thirty years.

Term life is popular since it uses big payments at a reduced expense than permanent life. There are some variations of common term life insurance policy plans.

Long-term life insurance coverage plans develop money value as they age. The cash value of whole life insurance coverage plans grows at a fixed rate, while the cash money worth within global plans can change.

Rumored Buzz on Paul B Insurance

If you compare typical life insurance policy rates, you can see the distinction. $500,000 of entire life protection for a healthy 30-year-old lady costs around $4,015 each year, on average. That same level of coverage with a 20-year term life plan would set you back an average of concerning $188 every year, according to Quotacy, a brokerage firm.

Variable life is one more permanent life insurance policy option. It's a different to whole life with a fixed payment.

Here are some life insurance policy basics to help you better understand exactly how insurance coverage works. For term life policies, these cover the price of your insurance policy as well as management expenses.

his comment is hereReport this wiki page